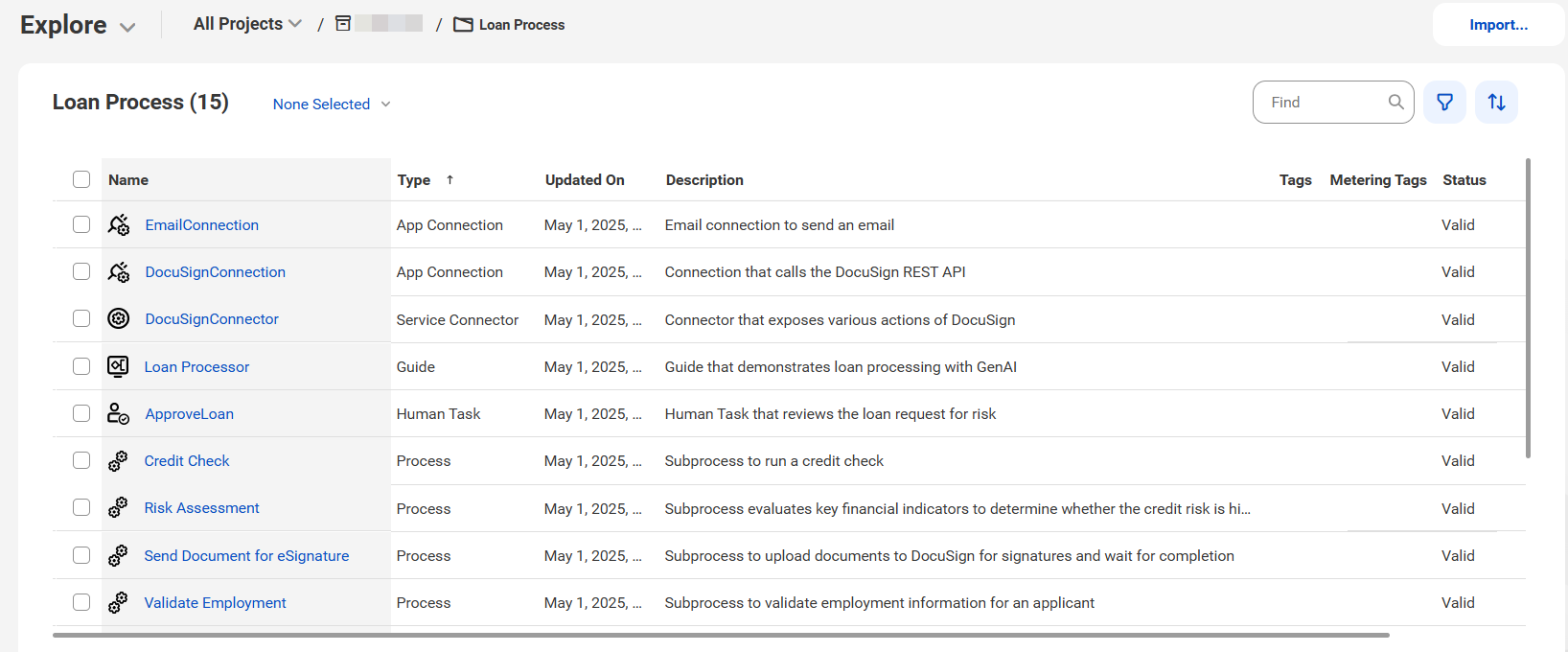

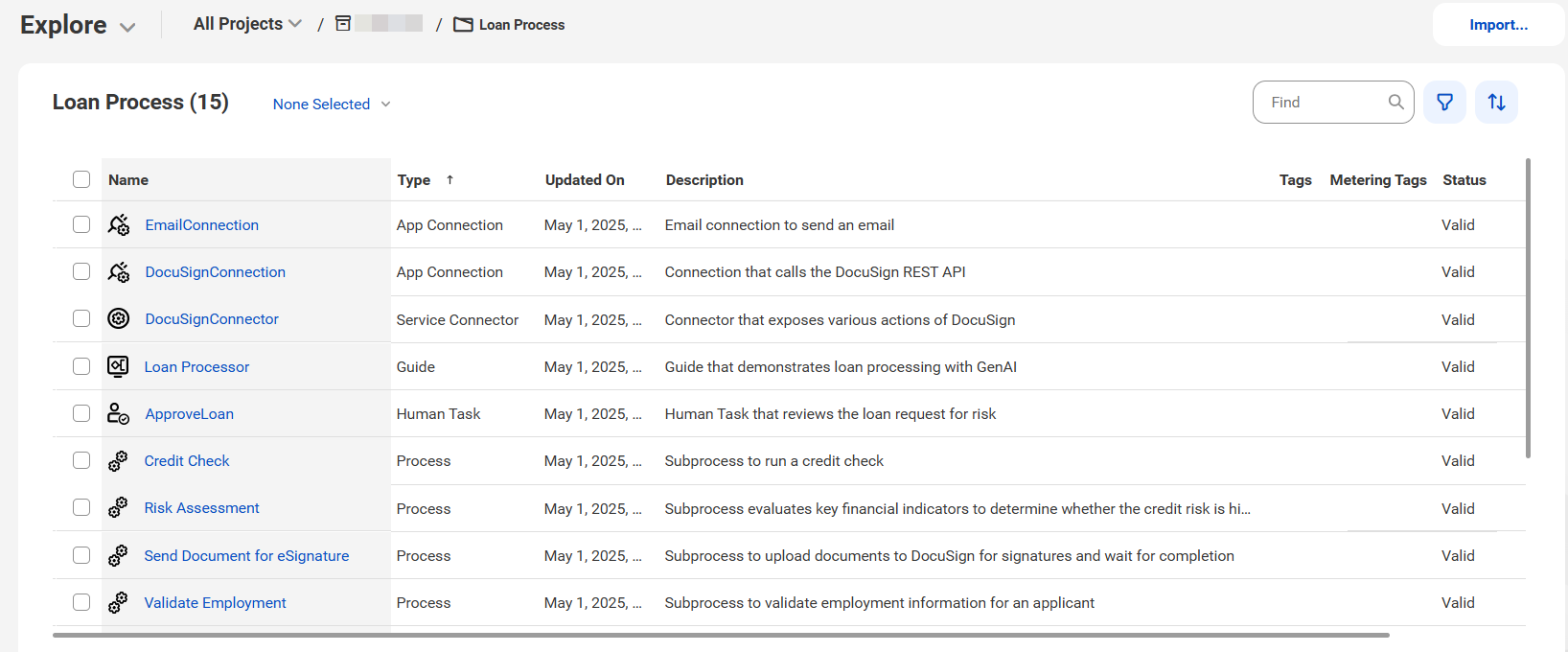

Asset Name | Asset Type | Description |

|---|---|---|

Address | Process object | Provides address details for loan processing. |

EmploymentDetails | Process object | Provides employment details for loan processing. |

LoanRequest | Process object | Provides the required fields for loan processing. |

PersonalDetails | Process object | Provides personal details for loan processing. |

DocuSignConnector | Service connector | Provides various actions to perform on DocuSign. |

EmailConnection | App connection | Email connection that is used to send emails. |

DocuSignConnection | App connection | Calls the DocuSign REST API. |

ApproveLoan | Human task | Reviews the loan request for risk. To work with this step, you must have the human task feature enabled for your organization. For more information, see Design. |

Credit Check | Process | Subprocess to run a credit check. The credit score is set to 700, by default. If the applicant's credit score is more than 700, the loan is approved automatically. Otherwise, the application is sent to the reviewer for approval. You can update the logic to get the credit history and credit score in real time by using credit unions such as Equifax and TransUnion as needed and modify the rules on when the loan must be approved or needs review. |

Risk Assessment | Process | Subprocess that evaluates key financial indicators to determine whether the credit risk is high or low.. |

Send Document for eSignature | Process | Subprocess to upload documents to DocuSign for signatures and wait for completion. |

Validate Employment | Process | Subprocess to validate employment information for an applicant. |

Validate Loan Information | Process | Subprocess to validate loan information requests. |

Process Loan Request | Process | The process is called by an HTTP request with basic information about the loan request as an incoming parameter. The process performs initial verification by validating the loan information. After successful validation, the process sends an email for application submission, generates a loan ID, and verifies employment details and income. The process then performs a credit check to assess any risk. If the credit score of the applicant is more than 700, the loan gets automatically approved and an approval email is sent to the applicant with the document for an e-signature. Otherwise, an email is sent to the applicant stating that the loan application is under review. Simultaneously, an email is sent to the reviewer to review the loan request. Based on the reviewer's decision, if the loan is approved, an approval email is sent to the applicant with the document for an e-signature. Otherwise, a loan rejection email is sent. |

Loan Processor | Guide | Demonstrates loan processing. |